KLCI Breaks 1,500 Points, Tech Stocks Lead Rally

Benefiting from the global tech stock rebound, the KLCI strongly broke through the 1,500 psychological barrier today, with trading volume hitting a three-month high.

We combine proprietary AI technology with decades of market expertise to deliver customized investment solutions for Malaysia's elite investors.

Leverage our proprietary AI algorithms to analyze Bursa Malaysia stocks instantly.

Years of Industry Experience

Customers Served

Recommendation Accuracy

Professional Support

Stay updated with the latest Bursa Malaysia news and market insights

Benefiting from the global tech stock rebound, the KLCI strongly broke through the 1,500 psychological barrier today, with trading volume hitting a three-month high.

Genting Malaysia's Q3 net profit increased 45% YoY, mainly benefiting from tourism recovery and the opening of new casino facilities.

Fed Chair Powell hinted at three possible rate cuts in 2024, driving Asian stock markets higher across the board. Malaysian stocks are expected to extend gains.

![[Breaking] Bank Negara Malaysia Keeps Interest Rate Unchanged](https://images.unsplash.com/photo-1554224155-6726b3ff858f?w=400&h=300&fit=crop)

Bank Negara Malaysia announced to maintain the Overnight Policy Rate (OPR) at 3.00%, in line with market expectations.

Public Bank has seen net foreign buying exceeding RM200 million for five consecutive days, with its stock price breaking through RM5.00 to hit an all-time high today.

Boosted by government green energy policies, the renewable energy sector on Bursa Malaysia surged today, with multiple solar concept stocks hitting limit up.

Our team comprises seasoned professionals with deep expertise in the Malaysian market, dedicated to preserving and growing your wealth.

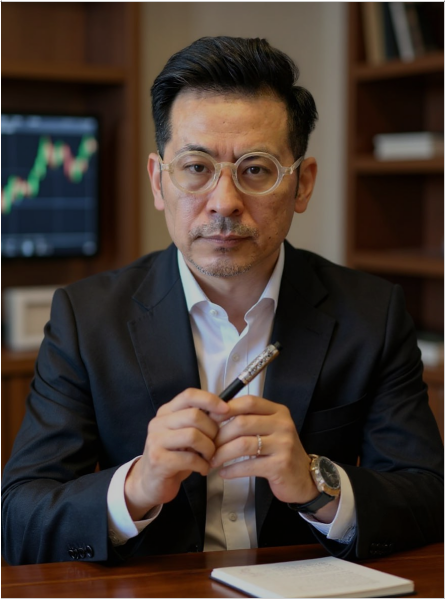

Malaysian stock market lecturer

Chief Executive Officer

With over 15 years of practical and teaching experience in the Malaysian stock market, this instructor focuses on investor education, helping students develop sound market knowledge, risk management awareness, and operational discipline. The curriculum centers on market structure, investment logic, and mindset management, discouraging short-term speculation and emphasizing the importance of long-term, stable participation. The teaching style is steady, systematic, and easy to understand, making it particularly suitable for stock market novices and working investors seeking to improve their investment stability.

Blue Chip Strategy

Chief Investment Officer

Mr. Ong Kian Leong is the Chief Investment Officer. He’s in charge of the whole institutional strategy and investment framework. With his CFA and CFP credentials, he’s got a deep research background and a long-term view on wealth management. He’s an expert in blue-chip strategies, focusing on solid companies with good cash flow. For him, it’s all about risk control and steady, long-term returns.

Technical Analysis

Investment Director

Mr. Tan Wei Kiong is a veteran investment professional and current Investment Director with extensive experience in stock and capital markets. He holds the CMT (Chartered Market Technician) certification and specializes in Technical Analysis, using price action, trends, and market structure to catch long-term and phase-based opportunities. Throughout his career, Mr. Tan has focused on stock research and trading strategies, with a deep understanding of market cycles, risk control, and fund management. He combines technical analysis with market sentiment to provide a disciplined decision-making framework for portfolios. As Investment Director, Mr. Tan Wei Kiong is responsible for strategy planning, asset allocation, and team decisions, aiming for sustainable long-term returns under strict risk management.

Fundamental Analysis

Senior Investment Analyst

Ms. Lily Wong currently serves as a Senior Investment Analysis Consultant, demonstrating meticulous and reliable professional expertise in investment research support and client proposal preparation. She holds the Chartered Financial Analyst (CFA) designation and possesses a solid foundation in financial analysis along with formal training in investment research. Ms. Wong specializes in Fundamental Analysis, helping consultants improve investment advice through systematic financial data, research, and valuation support. She focuses on logic and accuracy to provide steady, evidence-based research for decisions.

Industry / Sector Analysis

Investment Analyst

Ms. Lim Siew Ling is an Investment Analyst with solid skills in capital markets and research. She holds the CFP certification, combining research insights with asset allocation concepts. Ms. Lim specializes in industry and sector analysis, using macro and industrial research to evaluate cycles, competition, and trends for forward-looking support. In her work, she balances fundamental logic with risk awareness, using rigorous research to help build stable investment strategies that meet long-term goals.

.jpg)

High-Frequency Trading (HFT)

Equity Analyst

Ms. Cheng Ai Li Sha is a Stock Analyst with rich experience in stock market research and trading strategies. She is CFA certified and focuses on High-Frequency Trading (HFT) and quantitative strategies, and she is familiar with high-speed market data analysis and real-time execution. Ms. Cheng is good at combining fundamental research with high-frequency trading tech to provide precise and efficient support for the team. She focuses on risk management and data-driven analysis to catch trading opportunities in dynamic markets and create steady returns.

.jpg)

Equity Research

Investment Assistant

Stephanie Lim is an Investment Assistant with solid experience in stock research and investment analysis. Holding the CMT certification, he has a deep understanding of stock research and is good at combining technical analysis with market dynamics to provide high-quality research support for the investment team. In his work, Ms. Lim focuses on data accuracy and deep analysis, quickly catching market trends and potential investment opportunities. With rigorous research and sharp market insight, he helps with investment decisions and portfolio management to reach the team's steady operation goals.

.jpg)

Valuation Analysis

Financial Advisory Assistant

Ms. Tan Sze Yen is a Financial Consultant Assistant with a solid foundation in wealth management and investment support. She is CFP certified and familiar with systematic financial planning and investment evaluation. Ms.Tan specializes in Valuation Analysis, using financial models and company valuation to help financial consultants with investment plans and product selection. She focuses on data accuracy and risk awareness to provide reliable analysis for decisions. As a key member of the financial consultant team, Ms.Tan is dedicated to professional analysis and collaboration to help clients reach their long-term wealth goals.

.jpg)

Fundamental Analysis

Portfolio Manager

Fiona Chong Shi Hui is a Portfolio Manager with a solid background in asset management and stock investment. She holds the CCFA certification and has strong skills in financial analysis and investment evaluation. Ms.Chong specializes in fundamental analysis, using deep financial report research, company valuation, and industry analysis to find quality companies with long-term competitive edges and steady cash flow. In practice, she focuses on discipline and risk control to get stable and sustainable long-term returns for portfolios. As Portfolio Manager, Ms.Chong is in charge of building portfolios, asset allocation, and monitoring performance, using rational analysis and long-term value as her core philosophy.

Macroeconomic Analysis

Investment Consultant

Ms.Tan Pei Shan is an Investment Consultant with plenty of experience in capital markets and investment planning. She is CFA certified and focuses on Macroeconomic Analysis, using global trends, policy changes, and market data to evaluate the investment environment and give strategic advice. Ms.Tan has sharp market insight and a systematic approach, linking macro research with client goals to provide steady strategy support for portfolios. She focuses on risk control and long-term value to help clients achieve steady asset growth.

.jpg)

Earnings Forecasting

Investment Assistant

Amanda Lim is a Stock Investment Assistant with a solid foundation in research support and financial data analysis. She holds both FRM and CFP certifications, giving her a unique perspective that balances risk awareness with investment planning. Ms. Lim specializes in Earnings Forecasting. She’s great at building financial models and analyzing historical data to give the team forward-looking performance predictions. In her daily work, she focuses on data logic and making sure assumptions make sense to help make investment decisions more accurate and sustainable.

Fundamental Analysis

Investment Consultant

Michelle Lim is an Investment Consultant with rich experience and a solid background in investment analysis and wealth management. She holds CCFA, FRM, and CFP certifications, combining skills in investment research, risk management, and financial planning. Ms. Lim specializes in Fundamental Analysis, interpreting financial statements, company valuation, and industry trends to provide scientific investment advice. She focuses on risk control and long-term value to help clients grow their wealth through steady strategies.

Company Due Diligence

Investment Consultant

Ms. Wong Mei Ling is an Investment Consultant with meticulous and steady professional skills in corporate research and investment planning. She holds both CFP and CMT certifications, balancing financial planning and market analysis well. Ms. Wong focuses on Corporate Due Diligence, evaluating investment targets across corporate governance, financial structure, business models, and potential risks. In practice, she prioritizes fact-checking and risk identification to provide long-term value and defensive investment advice.

Fundamental Analysis

Investment Consultant

Claire Wong is an Investment Consultant with mature and systematic analysis skills in capital market research and investment planning. She is CFA certified, with a solid foundation in finance and a rigorous research framework. Ms. Wong specializes in Fundamental Analysis, looking deep into financial health, business models, and long-term competitive advantages to find a company's real value. She emphasizes rational judgment and a long-term view to help clients build steady, sustainable investment strategies.

.jpg)

Technical Analysis

Assistant Investment Manager

Ms. Chan Siew Yee is an Assistant Investment Manager with plenty of experience in capital markets and executing investment strategies. She holds a CMSRL (Capital Markets Services Representative’s License) in Malaysia, meaning she’s fully licensed and knows all about regulatory requirements and compliance. Ms. Chan specializes in Technical Analysis, using price action, trends, and market signals to give the team precise and practical trading advice. She focuses on disciplined execution and risk management to help optimize portfolios and catch market opportunities.

BeginnerStock Basics

BeginnerStock Basics BeginnerTechnical Analysis

BeginnerTechnical Analysis BeginnerFundamental Analysis

BeginnerFundamental Analysis BeginnerRisk Management

BeginnerRisk Management BeginnerWealth Planning

BeginnerWealth Planning BeginnerMarket Insights

BeginnerMarket InsightsOur commitment to excellence extends beyond financial returns. We believe in creating lasting value for our clients and helping every investor achieve their wealth growth and legacy goals.

Discover Our Impact